Managing your SMSF clients like a pro with Ignition

Managing your SMSF clients like a pro with Ignition

Painless SMSF client management with Ignition

With the recent increased popularity of Self Managed Super Funds, a lot of practices are starting to realise the huge opportunity to offer tailored advisory services to their client base. With any increased capacity, comes increased admin stress on a business, which is where Ignition can help.

Government regulatory changes, as well as frequent changes to laws around SMSF makes it imperative to have a clear agreement between you and your clients before you offer ANY advice.

The Good News

Ignition was designed to eliminate friction around client agreements so that you can get on with the real work – looking after your clients.

This is no different when it comes to your non-business clients, especially when you are dealing with such a heavily regulated industry. With PI you can create a smart proposal in minutes which includes an inbuilt electronic signature and a secure payment gateway to ensure you get paid on time, every time.

The Even Better News

If you are like many advisers at the moment, you are seeing a record volume of Self Managed Super Fund enquiries coming through your door, all which need to have a solid agreement with scope to update the terms on a regular basis with yearly renewals at the very least!

Ignition offers bulk proposal creation services free of charge to new and existing users who want to offer a standardised service offering to their clients.

In under 10 minutes you can have dozens, hundreds or even thousands of SMSF proposals created and sent out to your clients, ready for signing with payment collection enabled.

Here’s how it works:

- Upload your SMSF clients to Ignition via the Client Upload service in-app.

- Once you’ve saved the proposal(s) you simply need to export your SMSF clients from Ignition and then add the Proposal ID number next to the corresponding client in the spreadsheet. Follow the steps in this article for best results.

- Email the spreadsheet to the on-boarding team onboarding@practiceignition.com

- The team will come back within 24 hours to let you know that the upload is complete. All of your proposals will be in draft where you can review them and send individually, or send them all at once!

SMSF Smart Proposals

So what does a SMSF Smart Proposal look like to your clients?

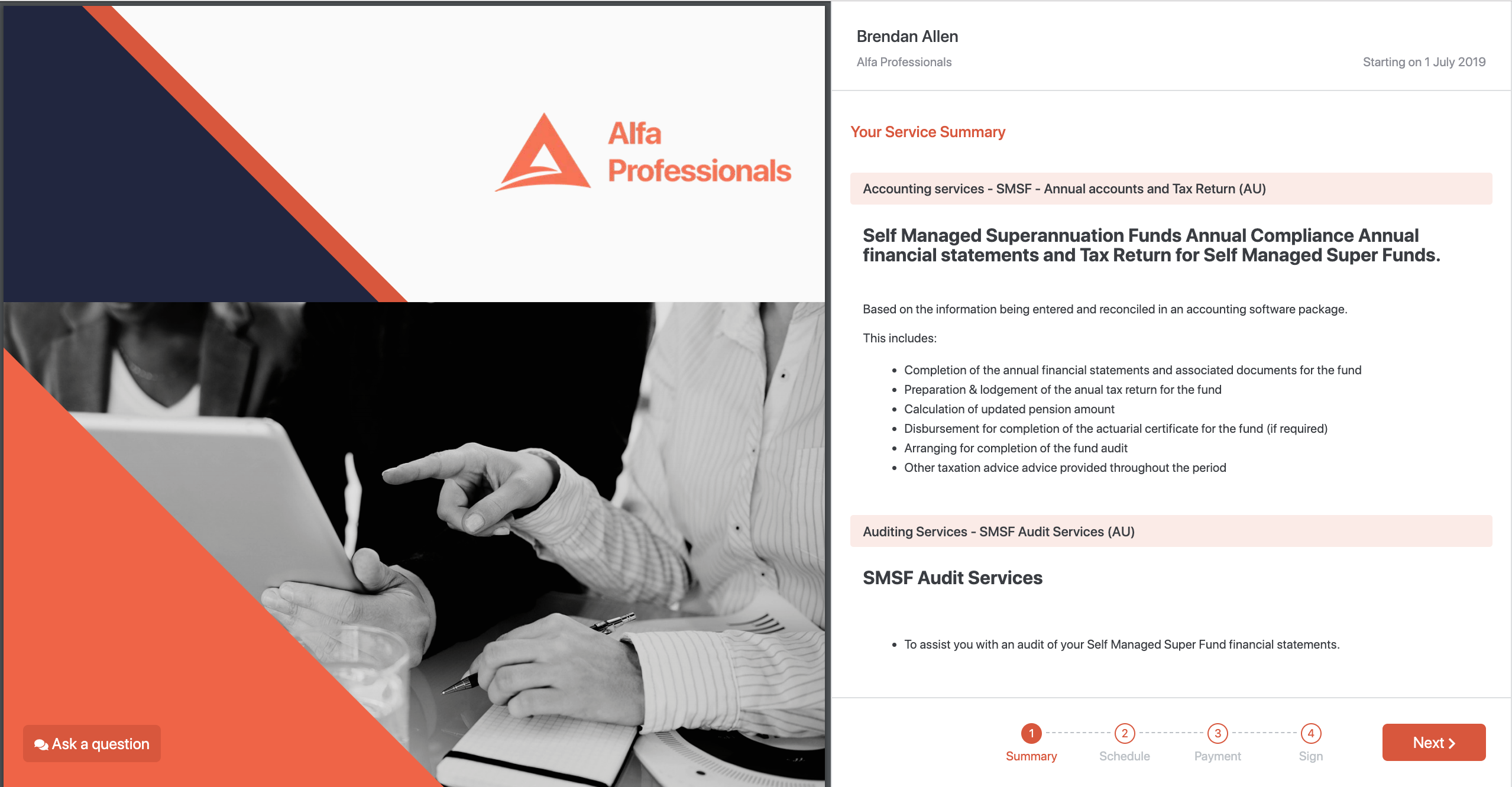

Your client experience is one of the most important aspects of your business so It’s important to understand how your client interacts with their proposal. Let’s take a look at a completed PI Smart Proposal and go through some tips and tricks on how to get the highest acceptance rate.

In this example, we are simply offering our clients a single SMSF Compliance Service plus a SMSF Audit service, both paid monthly via the PI Payments feature.

The first page outlines the value we are offering our client with a brief description of the services within the Smart Proposal.

The second page makes sure the client knows exactly how much they will be paying for their services. In this case, services are billed monthly.

Here your clients are able to enter their Credit Card or Bank Details which are stored securely. Each month on the billing day of your choice, the funds will be debited from your client’s card or bank account automatically.

Finally, your client’s signature is captured electronically and the proposal process is complete!